Mastering Tax Preparation in Scotch Plains, NJ: Your Key to a Smooth Tax Season

Embarking on the tax preparation journey in Scotch Plains, NJ, presents a unique set of challenges for residents. Navigating through the intricacies of local tax laws requires a tailored approach, but with the right strategies, you can transform this typically daunting task into a manageable and even rewarding experience. In this comprehensive guide, we'll delve into specific measures crafted for Scotch Plains residents, offering insights to simplify their tax preparation journey and alleviate the usual burdens associated with the tax season.

Expert Tips for New Brunswick NJ Tax Preparation: Simplify Your Tax Season Today

Tax season in New Brunswick, NJ, with its myriad rules and regulations, can often feel like navigating a complex maze for residents. However, with a solid understanding of local tax laws and the adoption of efficient strategies, the experience can be transformed into a manageable and potentially rewarding one. In this comprehensive guide, we'll delve into specific steps tailored for New Brunswick residents to streamline their tax preparation process and alleviate the stress associated with tax season.

Expert Tips for Perth Amboy NJ Tax Preparation: Simplify Your Tax Season Today

Navigating the intricacies of tax season in Perth Amboy, NJ, requires a tailored approach to the local tax landscape. Just like in Cranford, residents in Perth Amboy need to be aware of specific regulations, deductions, and credits that can impact their tax liabilities positively. In this comprehensive guide, we'll explore practical steps designed for Perth Amboy residents to simplify their tax preparation process and turn tax season into a manageable and potentially rewarding experience.

Navigating Tax Changes in 2024: What You Need to Know

As we step into a new year, taxpayers across the country are likely focusing on filing their taxes for 2023. However, it’s important to anticipate and brace for potential changes in tax regulations that could significantly impact your financial planning for the coming year as well. Understanding these alterations is crucial for individuals, businesses, and tax professionals alike, as it directly influences tax liabilities, deductions, credits, and overall financial strategies. Let’s delve into the anticipated tax changes for your 2024 finances and what you need to know to navigate them effectively.

How to Earn Tax-Free Rental Income — Legally

Here’s how it works: You can rent out your personal residence (e.g., primary, secondary, or vacation home) during a significant event, for example, and any money earned from the short-term rental isn’t subject to income tax if the rental period doesn’t exceed 14 days in the tax year. That applies to any amount you charge for the rental. However, the income generated becomes taxable if you rent your personal residence for more than 14 days in a tax year. As a result, keeping track of your rental days with good documentation is crucial.

NY Minimum Wage Increase Begins January 1st

Beginning on January 1st, 2024, New York’s minimum wage will increase to $16 per hour in New York City, Westchester, and Long Island, and $15 per hour for the remainder of the State. Further increases of $0.50 per year will continue through January 1st, 2026. Starting in 2027, the NYS Department of Labor will establish future annual minimum wage increases tied to inflation and keeping pace with regional costs of living.

How much New Jersey's minimum wage will increase on Jan. 1, 2024

New Jersey’s statewide minimum wage will be raised by $1 to $15.13 per hour for most employees on Jan. 1, 2024. The increase was part of a scheduled hike stemming from a 2019 bill signed by Gov. Phil Murphy. The legislation phases in a $15 an hour minimum wage, which will be reached by 2024.

Expert Tips for Irvington NJ Tax Preparation: Simplify Your Tax Season Today

Navigating the complexities of tax season in Irvington, NJ requires a tailored approach that takes into account the unique local regulations and considerations. In this comprehensive guide, we'll explore specific steps designed for Irvington residents to simplify their tax preparation process and alleviate the stress associated with this annual task.

Expert Tips for Livingston NJ Tax Preparation: Simplify Your Tax Season Today

Embarking on the intricate journey of tax preparation in Livingston, NJ, presents its own set of challenges. However, unraveling the nuances of local tax laws and implementing effective strategies has the potential to transform this experience into a more manageable and potentially fulfilling endeavor. In this comprehensive guide, we will explore precise measures customized for Livingston residents to simplify their tax preparation journey, ultimately alleviating the burdensome nature often associated with the tax season.

What You Need to Know about Deducting Your Holiday Charitable Donations

As the holiday season approaches, many individuals engage in charitable giving to support causes close to their hearts. Not only does this act of generosity benefit communities in need, but it can also offer potential tax advantages. However, it’s important to understand how to take advantage of this added perk, so you can ensure that the donations you make are not only doing a lot of good in the world, but that they are also tax deductible for the approaching tax season. Keep reading to get tips and guidance that will help you better understand how your charitable donations impact your tax deductions.

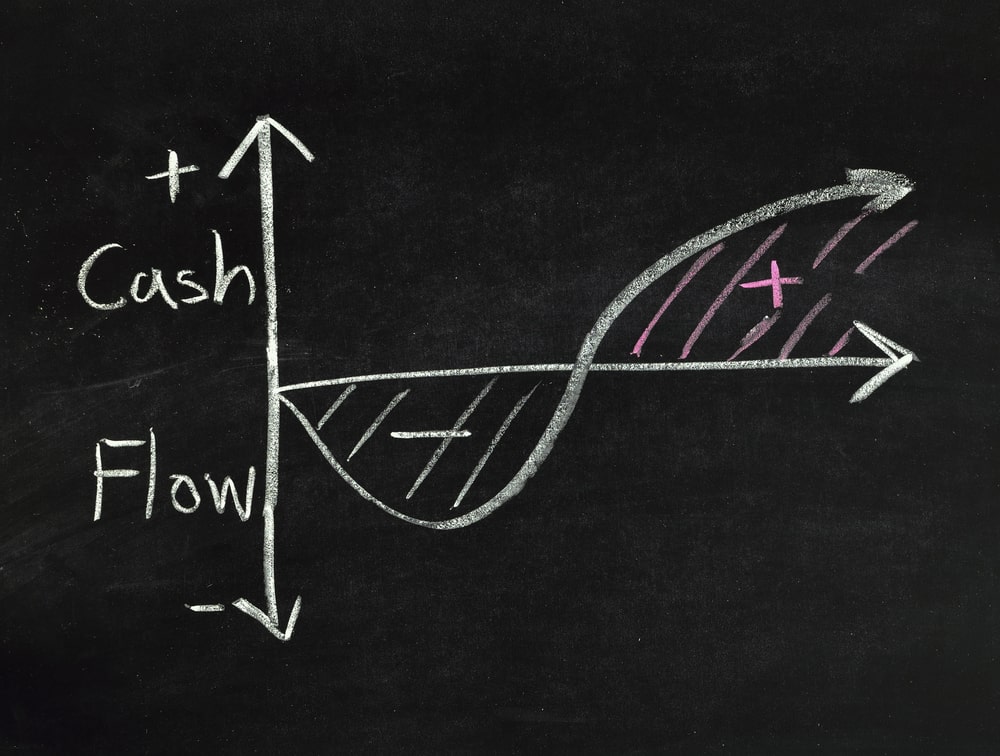

10 Tips for Managing Your Cash Flow to Your Business's Greatest Advantage

In the complex landscape of business management, one of the most crucial aspects that often remains underemphasized is cash flow management. Efficiently managing cash flow is vital to the survival and success of any business. At Demian & Company CPAs, we understand the significance of sound financial management, and we're here to provide you with professional insights and guidance to help you manage your business's cash flow effectively. Here are some helpful tips for managing your cash flow to your business's greatest advantage.

Middlesex County, NJ Tax Preparation: Demian & Company, CPAs

At Demian & Company, CPAs, we pride ourselves on being more than just an accounting firm. With a dedication to excellence and a commitment to providing top-tier financial services, we are your trusted partner in navigating the complexities of taxes, bookkeeping, and financial planning. With three conveniently located offices, we serve the vibrant communities across Middlesex County, NJ, and Union County, NJ, ensuring accessibility and personalized attention for our clients.

Child Tax Credit: Did you sign up for the $3600 payment? You're probably getting your payment this date.

The Child Tax Credit (CTC) allows parents and caregivers to reduce their tax rates and can even earn a refund amounting to $3600 per child. Payment dates not being made until mid-February to allow due process of claims, whilst precise dates vary individually and can be calculated online.

IRS Announces 2023 Form 1099-K Reporting Threshold Delay

Following feedback from taxpayers, tax professionals, and payment processors and to reduce taxpayer confusion, the Internal Revenue Service delayed the new $600 Form 1099-K reporting threshold requirement for third party payment organizations for tax year 2023 and is planning a threshold of $5,000 for 2024 to phase in the new law.

Tax-Efficient Investment Strategies for Long-Term Wealth

When it comes to building long-term wealth, tax-efficient investment strategies play a crucial role in maximizing your returns and preserving your hard-earned money. Taxes can erode your investment gains significantly if not managed properly. In this article, we will explore the importance of tax-efficient investing and provide you with actionable strategies to help you keep more of your money working for you over the long haul.

How to avoid paying taxes on Social Security income

Yes, it’s possible to avoid paying taxes on your Social Security income, but it requires some careful maneuvering. While avoiding taxes on your monthly benefit check may sound like a good thing, retirees and other beneficiaries may want to think twice before trying to make it happen.

2024 IRS Tax Changes May Make Your Paycheck Bigger Next Year

Some Americans may fall into a lower tax bracket next year. The IRS announced key tax code changes on Thursday, including increases to 2024 federal income tax brackets and the standard deduction. This move was in response to sticky inflation, which has kept prices high all year. These changes will apply to your 2024 taxes, which you'll file in 2025 -- and could affect the amount of taxes that are withheld from your paycheck.

Expert Tips for West Orange, NJ Tax Preparation: Simplify Your Tax Season Today

Embarking on the journey of tax preparation in West Orange, NJ, requires a nuanced understanding of the local tax landscape. Unraveling the intricacies of tax laws specific to this area can transform the taxing experience into a more manageable and potentially rewarding endeavor. In this comprehensive guide, we'll delve into tailored strategies designed for West Orange residents, offering insights to simplify their tax preparation journey and alleviate the typically burdensome nature of the tax season.

Expert Tax Preparation in Woodbridge, NJ: Demian and Company, CPAs

In the bustling landscape of Woodbridge, NJ, financial excellence isn't just a goal – it's a necessity. At Demian and Company, CPAs, we don't just offer services; we provide Woodbridge NJ tax preparation solutions that empower your financial journey.

Expert Tips for Bloomfield, NJ Tax Preparation: Simplify Your Tax Season Today

Embarking on the journey of tax preparation in Bloomfield, NJ, presents its own set of challenges. Navigating through the intricate web of rules and regulations during the tax period can be a daunting task. However, unraveling the subtleties of local tax laws and implementing effective strategies has the power to turn this experience into a more controllable and potentially fulfilling endeavor. In this comprehensive guide, we will explore precise measures customized for Bloomfield residents to simplify their tax preparation journey, ultimately easing the burdensome nature often linked with the tax season.

IRS tells small businesses to withdraw ineligible claims for lucrative tax credit

The IRS is urging small business owners who claimed a lucrative tax credit to review their eligibility again and promptly withdraw any unqualified applications. The announcement this week from the IRS revolves around the employee retention credit, or ERC, worth up to tens of thousands of dollars. If business owners find themselves ineligible, the Internal Revenue Service has provided several methods for them to withdraw their ERC claim depending on the status of their return.