10 Tips for Managing Your Cash Flow to Your Business's Greatest Advantage

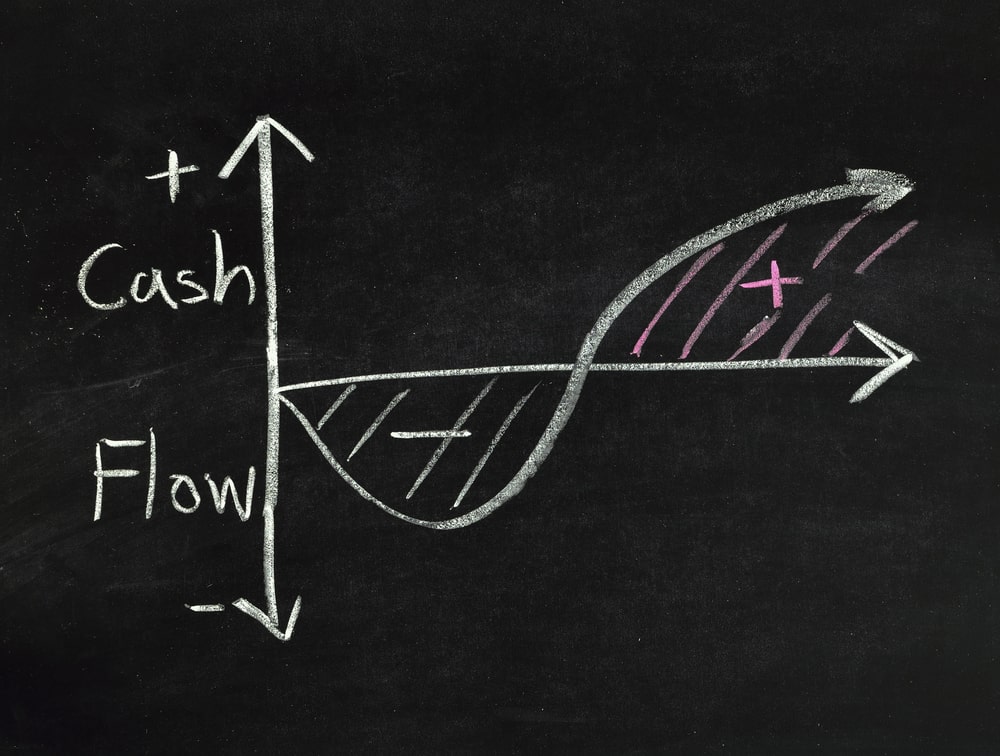

In the complex landscape of business management, one of the most crucial aspects that often remains underemphasized is cash flow management. Efficiently managing cash flow is vital to the survival and success of any business. At Demian & Company CPAs, we understand the significance of sound financial management, and we're here to provide you with professional insights and guidance to help you manage your business's cash flow effectively. Here are some helpful tips for managing your cash flow to your business's greatest advantage.

In the complex landscape of business management, one of the most crucial aspects that often remains underemphasized is cash flow management. Efficiently managing cash flow is vital to the survival and success of any business. At Demian & Company CPAs, we understand the significance of sound financial management, and we're here to provide you with professional insights and guidance to help you manage your business's cash flow effectively. Here are some helpful tips for managing your cash flow to your business's greatest advantage.

Establish a Robust Cash Flow Forecast

The foundation of effective cash flow management is a well-structured cash flow forecast. This involves projecting your incoming and outgoing cash flows over a specific period, typically a month or a quarter. A precise forecast allows you to anticipate potential shortfalls and surpluses, enabling you to make informed financial decisions.

Our experienced accountants can help you create a comprehensive cash flow forecast tailored to your business. With our expertise, you can anticipate fluctuations and ensure your business has the liquidity it needs to operate smoothly.

Monitor Your Accounts Receivable

Timely and efficient accounts receivable management is essential for maintaining a healthy cash flow. It's crucial to invoice clients promptly and follow up on overdue payments. Establish clear payment terms and consider offering incentives for early payments to encourage prompt settlements. At Demian & Company CPAs, our team can assist you in implementing best practices for accounts receivable management, ensuring your cash flow remains uninterrupted.

Optimize Your Accounts Payable

While you strive to receive payments on time, you should also manage your accounts payable wisely. Negotiate favorable terms with your suppliers and vendors to extend your payment deadlines without incurring penalties. This will help you keep more cash on hand and reduce the pressure on your cash flow. Our experts can guide you in establishing efficient accounts payable processes that strike the right balance between maintaining vendor relationships and managing your cash flow effectively.

Maintain an Emergency Fund

One of the most prudent steps a business can take is to establish an emergency fund. This reserve can be a financial lifesaver during unforeseen events or economic downturns. It acts as a safety net, allowing your business to continue operating without major disruptions. Our CPAs can advise you on the optimal size and management of your emergency fund to ensure it meets your business's unique needs.

Analyze and Reduce Unnecessary Expenses

Regularly review your business's expenses to identify areas where you can cut costs without compromising the quality of your products or services. This exercise should be done meticulously, and it may involve renegotiating contracts, eliminating wasteful spending, or identifying more cost-effective suppliers. Our skilled professionals can help you identify opportunities for cost savings while preserving your business's efficiency.

Diversify Your Revenue Streams

Overreliance on a single source of income can leave your business vulnerable to fluctuations in that market. Diversifying your revenue streams can help stabilize your cash flow, even during challenging economic times. At Demian & Company CPAs, we can collaborate with you to analyze potential opportunities for diversification within your industry or explore new markets.

Invest in Technology

Technology can play a pivotal role in managing your cash flow effectively. Implementing accounting and financial management software can streamline your processes, reduce errors, and provide real-time insights into your financial health. Our experts can guide you in selecting the right software and ensure its seamless integration with your existing systems.

Secure Financing When Needed

There may be times when your business requires additional funds to cover unexpected expenses or to invest in growth opportunities. It's essential to have a financing strategy in place for such situations. Our CPAs can help you explore various financing options, from traditional bank loans to lines of credit or even equity investments.

Stay Informed about Tax Implications

Taxes have a significant impact on your cash flow. Staying informed about tax regulations, deadlines, and potential deductions is essential. Our team of experts is well-versed in tax matters and can assist you in optimizing your tax strategy, ensuring that you don't pay more than necessary and have the necessary funds set aside to meet your tax obligations.

Regularly Review and Adjust Your Cash Flow Strategy

The business landscape is dynamic, and your cash flow strategy should be too. Regularly review your cash flow forecast and adjust it as needed to reflect changing circumstances. Our CPAs can help you stay on top of these changes and ensure your cash flow strategy remains aligned with your business's goals.

Managing your business's cash flow is a multifaceted task that requires meticulous planning, regular monitoring, and strategic decision-making. By following these tips, you can ensure that your business's cash flow works to your greatest advantage, providing the financial stability and flexibility necessary for long-term success.

At Demian & Company CPAs, we are dedicated to helping businesses like yours achieve their financial goals. Our experienced team of business accountants is ready to assist you in implementing these tips and developing a tailored cash flow strategy for your business. Don't hesitate to contact us today to schedule an appointment and take the first step toward optimizing your cash flow management. Your business's financial well-being is our priority, and we look forward to helping you succeed.