Your next tax refund may be smaller, IRS warns: Here’s why

The Internal Revenue Service is issuing a warning for 2023: You likely won’t receive as large a tax refund as you have in the past

4 Tax Credits With Which You Can Deduct Up To $8,000 This Tax Season

With the start of a new year, millions of taxpayers across America get ready to file their taxes in time to avoid penalties but also to enjoy some of the multiple tax credits available to them. The pandemic started a trend in which individuals have been receiving bigger tax refunds than before, given the emergency funds handed out to help residents go through the pandemic. This year there will be four major tax credits that most of the taxpayers will be able to apply for, according to The Sun: earned income tax credit, child tax credit, solar tax credit, and electric vehicle tax credit.

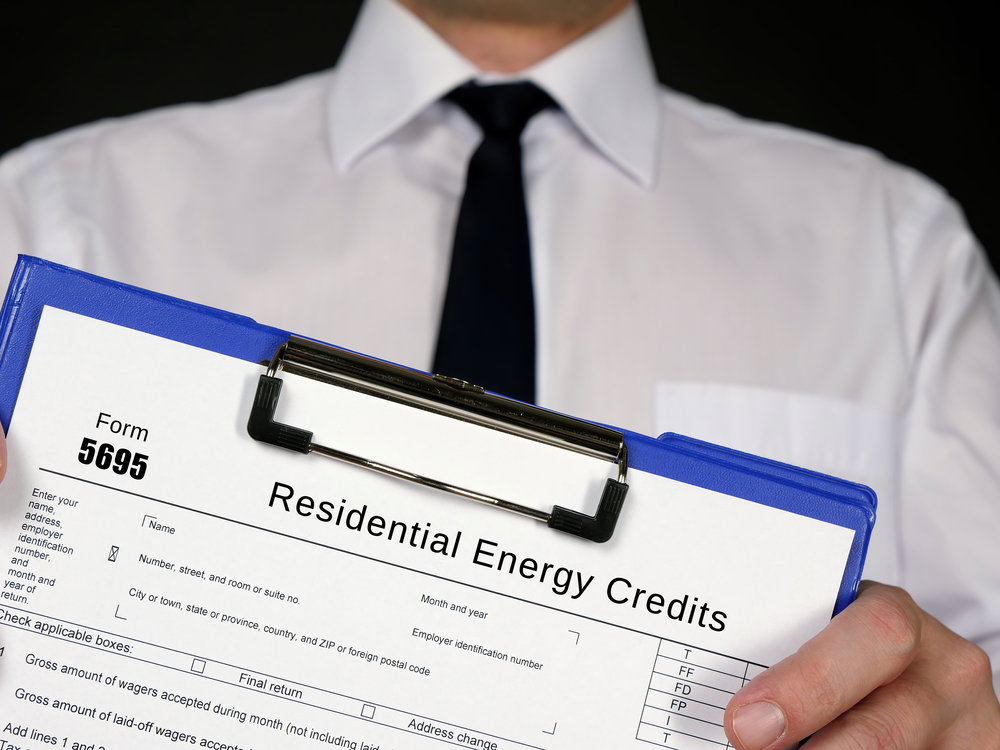

Form 5695: Which Renewable Energy Credits Apply For The 2023 Tax Deduction?

Form 5695 is used to apply for tax deductions of certain residential energy credits. There are a couple that are deductible in 2023.

New Jersey’s Newest $3,000 Stimulus Leaves Out Very Important Group

According to NewsBreak.com, "millions of New Jersey residents will receive a stimulus payment of $3,000 to help families in this challenging time."

Create an Online IRS Account Before 2023 Tax Season: Why and How to Do It

Setting up your online IRS account now could pay dividends when it comes time to file your 2022 tax return.

The Complete List Of Eligible Cars For The $7,500 EV Tax Credit

The Internal Revenue Service has released a preliminary list of electric vehicles that qualify for the U.S. federal government’s tax incentives for clean vehicles - and even the automakers find the IRS's new EV incentives complicated. Not to worry! Everything will be okay.

Here’s How Much Increases To The Standard Deduction Could Save You On Taxes

The Internal Revenue Service today announced the tax year 2023 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes.

IRS Announces Delay For New $600 Threshold For PayPal, Venmo Payments

The Internal Revenue Service announced a delay in reporting thresholds for third-party settlement organizations set to take effect for the upcoming tax filing season. As a result of this delay, third-party settlement organizations will not be required to report the tax year 2022 transactions on a Form 1099-K to the IRS or the payee for the lower $600 threshold amount enacted as part of the American Rescue Plan of 2021.

How Does Withdrawing from Retirement Accounts Early Impact Your Taxes?

Placing money into a retirement account can have both immediate tax benefits and future financial benefits. It’s a smart move all around to be putting funds into your retirement accounts regularly. However, in some cases, you may need to withdraw money from those accounts before you retire. What happens if you withdraw from retirement accounts before you reach retirement age? Keep reading to learn more about how this situation can impact your taxes.

Expert Tips for Carteret NJ Tax Preparation: Simplify Your Tax Season Today

Tax season, a time marked by a maze of rules and regulations, can be a daunting period for Carteret, NJ residents. However, mastering the local tax laws and adopting efficient strategies can convert the experience into a manageable and potentially rewarding one. In this comprehensive guide, we will explore specific steps tailored for Carteret residents to streamline their tax preparation process and ultimately alleviate the stress associated with tax season.

What Is a Schedule K-1 and How Is It Taxed?

Business owners and partners often receive a Schedule K-1 as one of their many tax forms at the beginning of the year. If you’re new to business ownership and this is your first year receiving a K-1, you might be uncertain about what this form is and how to handle it. As tax professionals who work with business owners on a daily basis, Demian & Company CPAs can help you appropriately file your return, and even help your business with issuing K-1s to partners. Keep reading to learn more about what a Schedule K-1 is and how to handle it on your tax return.

Expert Tips for Cranford NJ Tax Preparation: Simplify Your Tax Season Today

Tax season, with its labyrinth of rules and regulations, can be an overwhelming time for Cranford, NJ residents. However, understanding the nuances of local tax laws and adopting efficient strategies can transform the experience into a manageable and potentially rewarding one. In this comprehensive guide, we'll delve into specific steps tailored for Cranford residents to streamline their tax preparation process and, ultimately, alleviate the stress associated with tax season.

How Planned Giving Can Benefit You and Your Heirs

Planned giving is a popular option that individuals use to better manage their estate and plan for their legacy after death. But what exactly is planned giving, and how does it benefit you and those that you choose to leave your estate to? While planned giving is more complex than can be covered in one article, we’ll touch on the basics of it below. If you have further questions about planned giving and how it can benefit you and your heirs, contact our accountants at Demian & Company CPAs today.

Why You Should Meet with a CPA before the End of the Year

The holiday season is here, and that means the New Year is just around the corner. While you probably already have a long list of things to do before the ball drops on New Year’s Eve, there’s one other thing you should add to that last: meeting with a CPA. Why is it so important to meet with a CPA before the New Year rolls around? Keep reading to find out.

How to Tell If Your Donation to Charity Will Be Tax Deductible

As we approach the holiday season, many people will be considering what charitable organizations they’d like to contribute to, and how much they’re going to give. Some people give to the same charities every year, while others may vary which causes they support. Still others may be considering making a significant donation for the very first time. Whichever situation you may be in, it’s important to consider whether or not your donation to any charity will be tax deductible. How can you tell if your donations are tax exempt? Keep reading to learn a few things to check before you donate.

Things You Can Do before the End of the Year to Save on Taxes

The right time to start thinking about this year’s tax return is at the start of the year. Aside from that, however, the best time to start thinking about it is right now. Disregarding your taxes—and how every financial decision you make impacts those taxes along the way—typically results in you paying far more in taxes than you should. If tax planning hasn’t been a priority for you so far this year, don’t worry; there are still a few things you can do before the end of the year to save on taxes. Keep reading to learn what they are.

How Working with a CPA Differs from Working with a Tax Preparer

When it’s time to get your taxes done, it’s important to understand the different types of professionals that are qualified to help you, and the qualifications that they hold. Different types of tax professionals can provide you with a different level of service and expertise on your tax return. CPAs in particular are the most highly qualified individuals for handling tax planning and preparation. Keep reading to learn more about how working with a CPA differs from working with a tax preparer on your return.

The Tax Extension Deadline Is Approaching: Make Sure You Don't Miss It with These Tips

If you were unprepared to file your tax return in April, you likely requested a tax extension. This pushed your new filing deadline out to October 17th (as October 15th falls on a Saturday this year). However, that deadline is now little more than two weeks away, and if you haven’t yet filed, you won’t have the option of extending your due date again. So, it’s extremely important that you not miss this deadline, and the best way to ensure that doesn’t happen is by starting to prepare now. Keep reading to get some tips on how to get yourself—and your tax return—ready before the deadline.

Reasons You Shouldn't Try to File a Business Tax Return on Your Own

When you’re a business owner, you have to wear many hats. At times you’re a manager, and at other times you’re a customer service representative. Sometimes you handle the marketing, and sometimes you might find yourself troubleshooting your equipment and playing an IT tech. But the one hat a business owner should never try to wear is that of tax advisor. Even if you’ve always prepared your personal tax return in the past, a business tax return is a different matter altogether, and you should never try to file it on your own. Keep reading to find out why.

What Happens If You Miss the Tax Extension Deadline for Your Business?

If you filed a business tax extension back in March, you received an additional six months to complete and submit your business tax return. While that might sound like plenty of time, your new tax deadline is now just 2 weeks away, on September 15th. If this deadline snuck up on you, you’re not alone. However, it’s incredibly important that you not allow the deadline to pass you by without filing your tax return. Missing the business tax deadline can have some consequences for your company and cost you thousands in additional fees and penalties. Keep reading to learn more about the types of penalties your company could face.

What You Should Know about Making Quarterly Tax Payments for Your Business

The majority of income-earners in the United States receive a paycheck on a regular basis that already has taxes taken out for them. However, those who have untaxed income often have to calculate and submit payments to the IRS on a quarterly basis in order to ensure that they’re not charged with underpayment penalties when filing their tax returns. Keep reading to learn what you should know about making quarterly tax payments for your business.