What You Should Know about Making Quarterly Tax Payments for Your Business

The majority of income-earners in the United States receive a paycheck on a regular basis that already has taxes taken out for them. However, those who have untaxed income often have to calculate and submit payments to the IRS on a quarterly basis in order to ensure that they’re not charged with underpayment penalties when filing their tax returns. Keep reading to learn what you should know about making quarterly tax payments for your business.

The majority of income-earners in the United States receive a paycheck on a regular basis that already has taxes taken out for them. However, those who have untaxed income often have to calculate and submit payments to the IRS on a quarterly basis in order to ensure that they’re not charged with underpayment penalties when filing their tax returns. Keep reading to learn what you should know about making quarterly tax payments for your business.

Why Do You Need to Make These Payments?

As we mentioned above, W2 income (and many other types of income) are taxed upfront. This is because our country’s tax system is intended to have taxpayers pay those taxes as they earn their income. However, many people—including business owners, self-employed contractors, and landlords—receive income that is not taxed when they receive it. These individuals are still expected to “pay as they go” like anyone else; they simply have to do it via quarterly payments instead of through automatic deductions on their paychecks.

While it might sound tempting to just pay everything you owe when you file your tax return, there are two main reasons this is a bad idea. First, this approach would leave you with a very large tax bill when you file, and you’re much more likely to find yourself without the funds to pay off that amount all at once. Additionally, the IRS can apply underpayment penalties to businesses and individuals that fail to pay a certain percentage of their taxes throughout the course of the year. If you don’t want to find yourself with an enormous bill that can have additional fees tacked onto it, you need to make quarterly payments.

Who Is Required to Do It?

Quarter tax payments are required of any individual or business that earns more than $500 in taxable income. This includes income sources like earnings from a business that you own or are invested in, self-employment income, interest on investments, income from rental properties, dividends, and any other untaxed income sources. If you’re not sure whether or not quarterly tax payments are expected of you, contact one of our CPAs to schedule a consultation and receive guidance on this matter.

How to Calculate Your Payment Amounts

If you are require to make quarterly tax payments, how do you determine how much to pay each quarter? To figure this out, it’s a good idea to have a copy of your past tax return. This can help you determine your average annual income from all untaxed sources, your deductions, and your credits. You’ll also need to know how much you’ve already paid in taxes. Remember that the numbers on your past tax returns are just a starting point; you’ll still need to account for any major changes in your income this year.

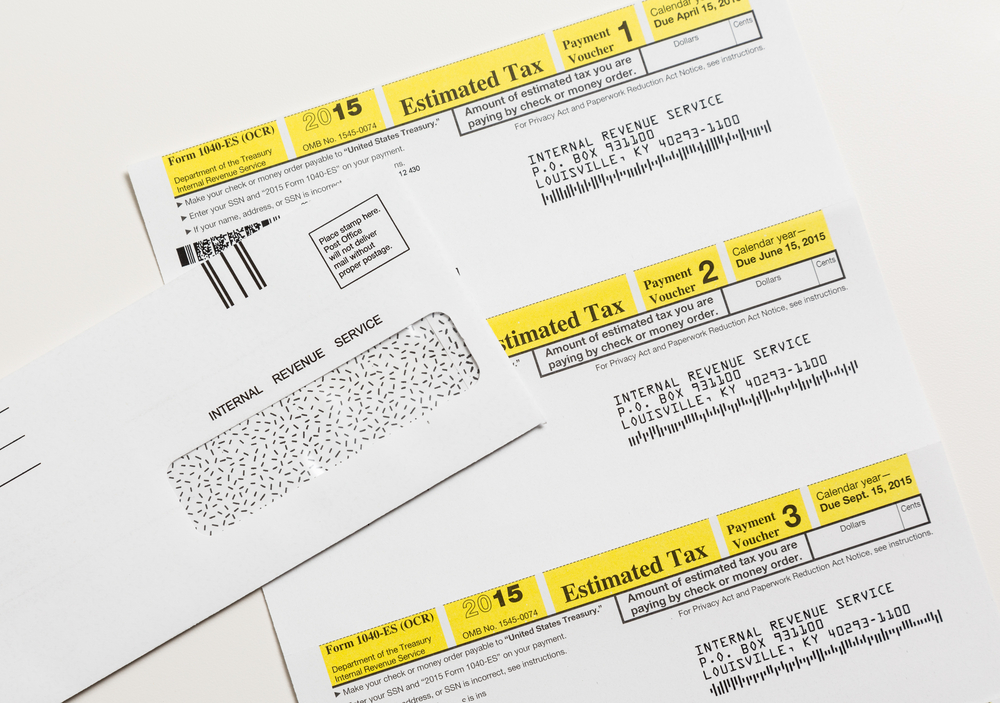

Once you have all this information available to you, use IRS Form 1040-ES to input your numbers and perform the necessary calculations to determine your tax liability for the year. Divide this number by four to determine the amount you should be paying each quarter. Because this is number is based on average anticipated income for the year, bear in mind that it can change. If your untaxed income increases or decreases significantly between quarters, you may need to adjust your next quarterly tax payment to account for it.

How Accurate Do You Need to Be?

Many people worry about their calculations for their quarterly tax payments not being exact. While precision is important in taxes, keep in mind that you’re not expected to get your quarterly payments to exactly match your overall tax liability for the year. Even when you have your taxes withheld from your paycheck, the amount you paid rarely matches the amount you should have paid—that’s what a tax return is for. Similarly, your quarterly payments may not be an exact match of what you actually owe; but when you file your return, any discrepancies will be corrected and you can pay the additional amount owed or receive a refund for your overpayment.

The goal with quarter tax payments is simply to pay as close to the correct amount as you reasonably can so that you’re not making a huge lump sum payment during tax season, and so you can avoid underpayment penalties for the year.

If you have further questions about making quarterly tax payments, please contact Demian & Company, CPAs, to schedule a consultation with our business tax professionals.