The New Tax Deadline Is Approaching: How to Avoid Late Fees

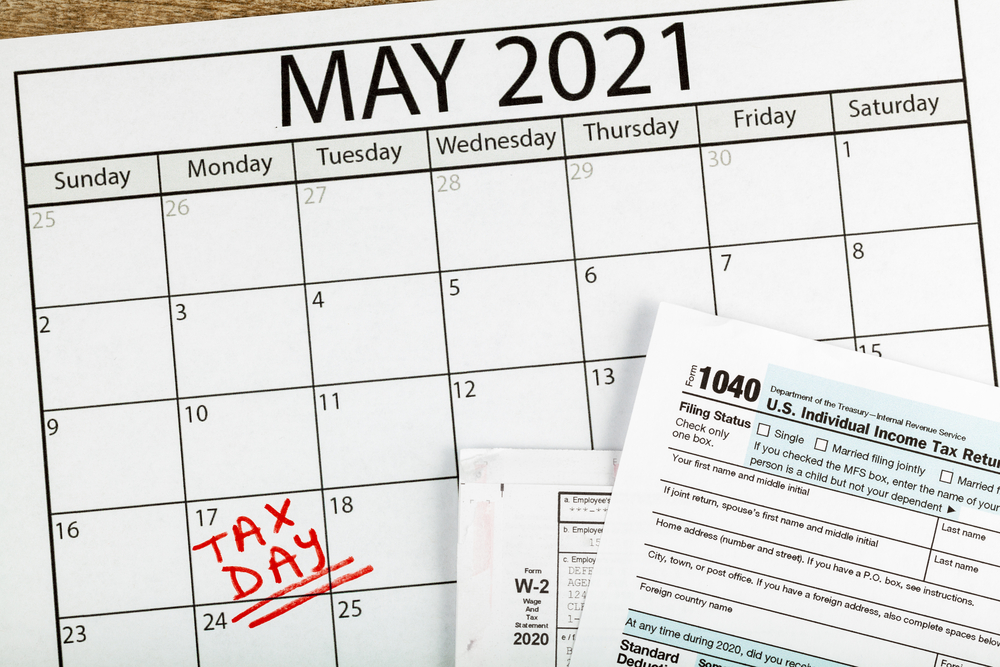

In case you weren’t aware, the tax deadline actually hasn’t passed yet. The IRS moved the 2021 tax deadline to May 15th to allow taxpayers more time to file, and to give themselves a bit more time to handle another round of COVID-19 relief checks. So, if you haven’t filed your 2020 tax return yet, it’s not too late to avoid late filing penalties! Here are your options.

In case you weren’t aware, the tax deadline actually hasn’t passed yet. The IRS moved the 2021 tax deadline to May 15th to allow taxpayers more time to file, and to give themselves a bit more time to handle another round of COVID-19 relief checks. So, if you haven’t filed your 2020 tax return yet, it’s not too late to avoid late filing penalties! Here are your options.

File Your Return

Obviously, your first option is always to file your full return. If you have all of the paperwork you need and just haven’t gotten around to filing, do it as quickly as possible. Whether you file your own return or work with a tax preparer, open that self-filing software or reach out to your accountant today—not tomorrow!—get to work on filing. You still have two weeks to get it ready, so you can get your full return in on time if you get started now.

File an Extension

Of course, many of the people who haven’t filed yet simply aren’t ready. Whether you’re trying to sort out some complicated issues with your finances or just waiting on some missing paperwork, your return still might not be prepared for submission, despite the extra month allotted by the IRS this year. If that’s the case for you, the first and easiest option available is to file an extension.

Filing an extension only takes a few minutes. You’ll just need to fill out Form 4868, which requests only a few lines of information from you. However, you’ll notice that one of the lines of information you have to fill out is how much you’re paying in your taxes at the time of submission. That’s because this type of extension is only an extension to file your return. It’s not an extension on paying your taxes. You will need to provide an estimate of your 2020 tax liability, the amount you paid in taxes that year, how much you now owe, and how much you’re paying.

If you do request an extension to file, you don’t actually have to pay that amount at the same time you submit Form 4868. You can wait until May 15th without worrying about penalties. However, any unpaid amount after that point will be subject to late payment fees and interest. Your actual return, however, won’t be due until October 15th.

Request a Payment Plan

But what if you know you’ll owe taxes that you can’t afford? Many people think the best solution to this problem is to simply avoid it. If you don’t file a return, the IRS won’t slap you with that tax bill, right? This is wishful thinking at best, and tax evasion at worst. It is always better to be proactive about your tax debt rather than trying to avoid the issue.

The IRS offers a few different repayment plans, and some are more difficult to qualify than others. If you genuinely cannot afford to pay your tax bill this year, we strongly recommend that you work with a CPA to find a repayment plan that fits your needs and proceed with the necessary applications. Failing to fill out the application properly can result in automatic rejection, so you want to ensure it’s done properly the first time. A CPA can also tell you what kind of payment schedule you can expect based on your finances and the individual plan for which you apply.

Contact a CPA Today

If you’re scrambling to get your return filed on time, it’s important that you contact your tax preparer immediately. We're busier than ever at this time of year, and if you hope to be able to work directly with your CPA before the tax deadline, you need to reach out to us today. We’ll do our best to get your return filed by the deadline, or to at least help you file an extension and submit an estimated payment to avoid late filing fees. We can also assist you with requesting an IRS payment plan, if needed.

Procrastination is never your friend. But if you’ve been procrastinating your taxes, there’s still time to file before the deadline. Contact us at Demian & Company CPAs today to get on the schedule and get your tax return in on time.