Are You Withholding the Right Amount from Your Paycheck?

This tax season, many taxpayers were shocked by the numbers they saw on their tax returns. A lot of people found themselves owing far more in taxes than they anticipated, and scrambled to pay the unexpected tax bill. This unpleasant surprise was largely due to the tax law changes implemented by the TCJA, which reduced the amount being withheld from many people’s paychecks. If you want to avoid a shockingly high tax bill again next year, it may be a good idea to adjust your withholdings now. Here’s what you need to know.

This tax season, many taxpayers were shocked by the numbers they saw on their tax returns. A lot of people found themselves owing far more in taxes than they anticipated, and scrambled to pay the unexpected tax bill. This unpleasant surprise was largely due to the tax law changes implemented by the TCJA, which reduced the amount being withheld from many people’s paychecks. If you want to avoid a shockingly high tax bill again next year, it may be a good idea to adjust your withholdings now. Here’s what you need to know.

What Is Withheld from Your Paycheck?

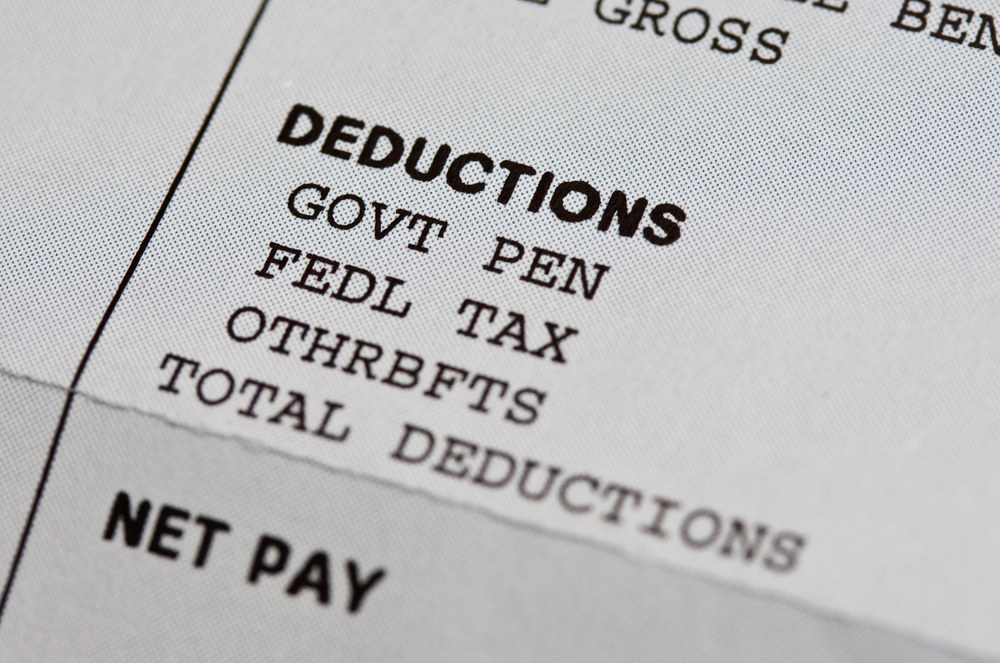

If you’ve never taken an in-depth look at your paycheck, it’s important to be aware of what is being deducted from your earnings. Obviously, you’re probably aware that taxes come out of your income before you receive your check; these are both state and federal taxes. You’ll also see a Medicare contribution deducted from your income. Additionally, if you have employer-provided insurance, a 401k, HSA, or FSA, these costs may be deducted from your paycheck before the tax deductions are even calculated.

That being said, most of these deductions are based upon information you supply to your employer. When you started your job, you filled out a W-4, or Employee’s Withholding Allowance Certificate. On this form, you can claim a certain number of allowances—one for yourself, one for a spouse, and one for each of your other dependents. The more allowances you take, the less money is withheld for federal taxes, which means you’ll get more money in your paycheck. Fewer allowances means more money will be taken out for taxes.

Do You Need to Adjust Your Withholdings?

Many individuals often fill out their W-4s when they start a new job, then don’t think about it again until they change jobs. However, it’s a good idea to examine your withholdings each year, and determine whether or not you should adjust them. Here are a few big reasons to adjust your withholdings:

- Marriage

- Divorce

- Having a child

- Buying a home

- Changing benefits

If any of this happened in the last year, you may want to adjust your withholdings. Additionally, as we mentioned at the beginning, you should adjust your withholdings if you want to reduce the amount of tax you owe when you file your return.

How Are Your Withholdings and Tax Return Connected?

Why does adjusting your withholdings impact your tax bill? As described above, the withholdings on your paychecks include federal taxes. When you file your return each year, you’re essentially “balancing your accounts” with the IRS. If they discover you haven’t been paying as much tax as you should, you’ll get a bill. If you’ve overpaid, they’ll send a refund.

Obviously, the ideal situation would be to pay the exact right amount of taxes throughout the year, and receive neither a bill nor a refund. But of course, this is basically unheard of. Instead, the best you can do is to adjust your withholdings to try to withhold closer to the right amount from each paycheck. When you do this, you’re paying your taxes more accurately as you go, and so you’ll have less “settling” to do with the IRS when tax season comes.

How Do You Adjust Your Withholdings?

Now that you have a thorough understanding of what your withholdings are and how they are connected to your tax bill, it’s time to talk about how to adjust them. It’s actually a very simple process. All you have to do is request a new W-4 from your HR department, or download one from the IRS website.

If you want to lower your tax bill in the coming tax season (which will be the case for most taxpayers after receiving their 2018 tax bills), then you will want to reduce the number of allowances on your W-4. This will cause more money to be taken out of each paycheck, but you should receive a lower tax bill (or perhaps even a refund, depending on how much you have withheld) when you file your return in 2020.

If you have any questions about how to adjust your withholdings, or how many allowances you should take on your W-4 in order to withhold the proper amount, contact one of our experienced CPAs. We’ll go over the form with you and discuss your unique financial situation so that you can adjust your withholdings properly, and avoid the same sticker shock you may have experienced this year.