QuickBooks Online: 2017 Software Review

Managing business accounts and books often requires a level of expertise and time investment that small business owners simply cannot afford to develop and maintain. While the ideal solution is often to hire a bookkeeper, a full-time employee doesn't fit into the budgets of many micro businesses, and it shouldn't have to.

Managing business accounts and books often requires a level of expertise and time investment that small business owners simply cannot afford to develop and maintain. While the ideal solution is often to hire a bookkeeper, a full-time employee doesn't fit into the budgets of many micro businesses, and it shouldn't have to.

Software solutions like QuickBooks Online offer intuitive accounting and bookkeeping tools to small business owners, so you can easily keep your books and accounts in order throughout the year, to complement your part time bookkeeper or CPA. This makes it easier and more cost effective to hand your accounts to a CPA for review and greatly simplifies your accounts at tax time, because everything is organized and in one place.

Intuit has remained a top brand in accounting and personal finance since the launch of their first program Quicken in 1983, but today, their QuickBooks solution is among the most popular accounting software in the world.

If you're looking for an accounting solution, we've taken the time to review QuickBooks Online: 2017 so you can decide if it's a good investment for your business.

What is QuickBooks Online?

QuickBooks online is a cloud based accounting and bookkeeping platform with multiple tiers and pricing levels for different types of users.

- QuickBooks Online Self Employed - $9.99 p/month

- QuickBooks Online Simple Start - $12.95 p/month

- QuickBooks Online Essentials - $26.95 p/month

- QuickBooks Online Pro - $39.95 p/month

Each of these offerings includes the same interface, with different features to suit different business types and structures.

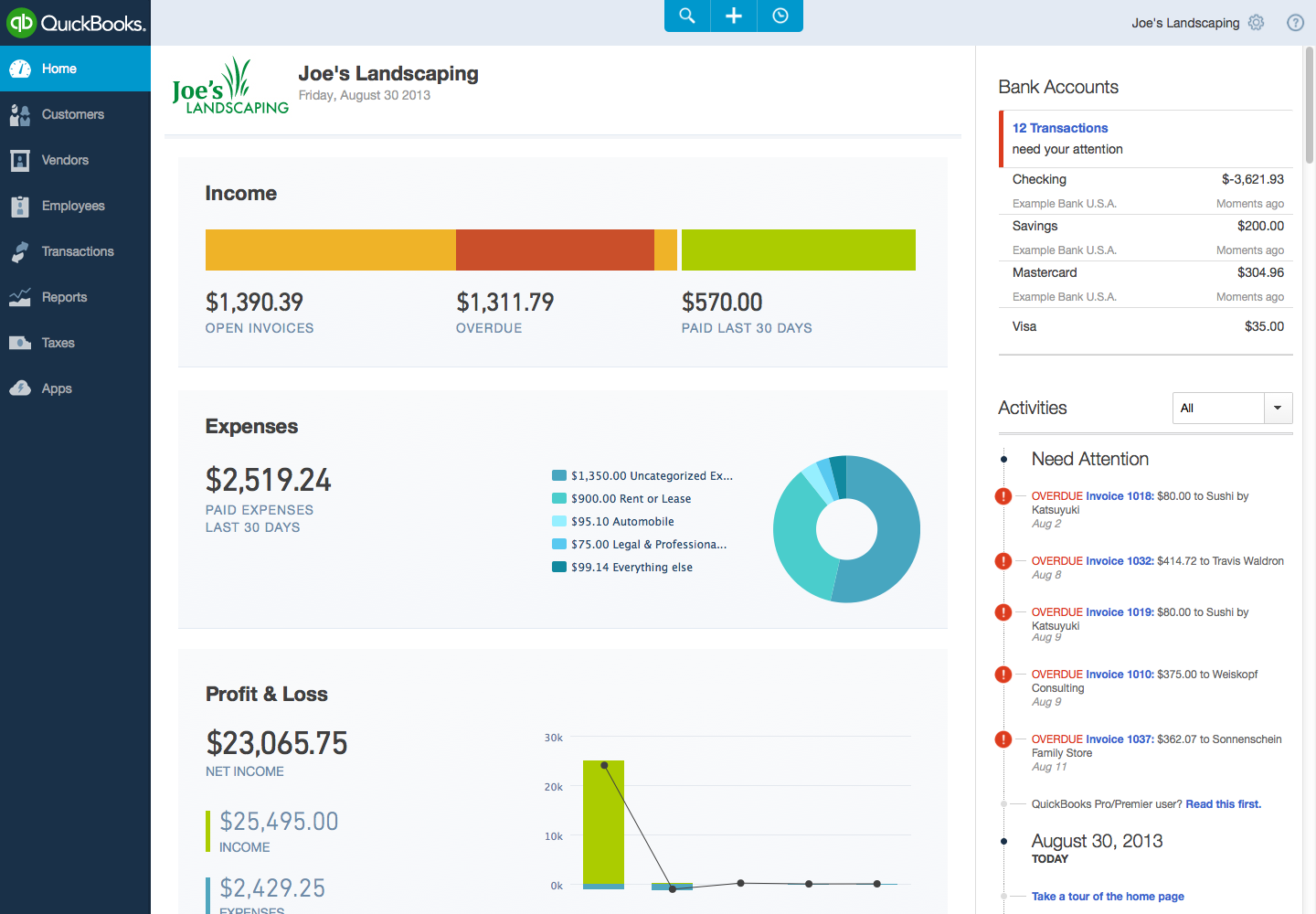

Interface – QuickBooks Online offers a smooth, user friendly design with logical layout, making it easy to learn and use. Most of the interface is geared towards users with a small amount of accounting knowledge, but you can use it with none. However, with accounting terminology and complex tax codes, you still need a CPA or bookkeeper to review your books.

Speed – QuickBooks Online 2017 offers extremely quick navigation and search, but entering transactions can take some time.

Support – Intuit offers stellar online and phone support with all their subscriptions

Features – QuickBooks Online 2017 offers over 30 features including over a dozen re-worked or new-to-QuickBooks additions, like "Starbucks Mode" for private use in public spaces.

- Create & manage invoices

- Track & organize expenses

- Track sales and income

- Track payments

- Create and print checks and invoices with online pay links

- Enter and manage bills

- Create and send invoices, quotes, and estimates

- Automatically calculate tax

- Insights

- Automated online banking

- Data export/import

- Multi-device sharing

- Cash flow management

- Over 30 types of reports

- Mileage tracking

- Vendor management (due dates, vendor invoices, outstanding invoices)

- Payroll

- Paperless receipts

- Much more

While the specific features you get depend on your QuickBooks Online subscription, you can choose an offering that gives you the tools you need and will use.

Cons

- Setup time can be lengthy. While you can just jump right in, QuickBooks online does not have a setup wizard, so you will have to import existing tax software data or add everything manually.

- Entering transactions is somewhat time consuming

- The program uses accounting terminology, even though most people who use it often do so without full accounting guidance. If this is a problem for you, have your accountant help you set it up.

Pros of QuickBooks Online 2017

- Great reporting tools

- Very easy to use

- Multiple record and transaction types

- Customizable report templates

- Strong invoicing tools

- Payroll for small business

- Fast interface

QuickBooks is a low-cost accounting tool that makes it easy for you to keep up with transactions, expenses, invoices and bookkeeping, all in an easy to use, mostly non-technical interface. While it won’t replace your CPA or bookkeeper, it will allow you to improve your accounting while spending less time on your daily books. And, with the help of a CPA to review and manage your accounts, you can easily maintain high quality books at a minimal cost to your business.