Child Tax Credit: When Will the IRS Start Refunding Your Credit Money this Tax Season?

For those early birds this year who've already submitted their tax returns, the IRS has sent back $13 billion in refunds. (Here's how to check the status of your refund.)

The average tax refund is almost 29% lower this tax season, early IRS statistics show

The IRS is writing smaller refund checks, on average, at the start of this year’s income-tax-filing season, according to new numbers from the tax agency. Federal income-tax refunds are averaging $1,395 so far, according to Internal Revenue Service numbers released Friday on the filing season that started less than two weeks ago.

How student loan forgiveness factors into your tax bill

Student loan borrowers who had a loan forgiven under President Biden may be off the hook for paying taxes on the erased debt.

Do You Have an IP PIN? What They Are and Why You Should Get One

In the ever-evolving landscape of tax regulations and cybersecurity threats, safeguarding your financial information is of paramount importance. One powerful tool in your arsenal is the IRS-issued Identity Protection Personal Identification Number (IP PIN). At Demian & Company CPAs, with our extensive experience in tax preparation, we understand the significance of this added layer of security. If you haven’t yet heard of this form of identity protection, keep reading to learn more about the intricacies of IP PINs, what they are, when they were instituted, their effectiveness, how to obtain one, and most importantly, how an IP PIN can shield you from falling victim to tax scams.

Expert Tips for South Orange, NJ Tax Preparation: Simplify Your Tax Season Today

Embarking on the journey of tax preparation in South Orange, NJ, presents its own set of challenges for residents. However, deciphering the nuances of local tax laws and implementing effective strategies can transform this task into a more manageable and potentially rewarding experience. In this comprehensive guide, we will explore tailored measures designed for South Orange residents to simplify their tax preparation journey, ultimately alleviating the often burdensome nature associated with the tax season.

Expert Tips for Orange, NJ Tax Preparation: Simplify Your Tax Season Today

Orange's tax landscape is uniquely characterized by local regulations and considerations that require special attention. Take the time to familiarize yourself with the specifics, such as local deductions and credits, to ensure that you're maximizing your potential savings. Staying well-informed serves as the foundation for a successful tax season.

Tips for Filing Your First Tax Return as a Business Owner

Filing your first tax return as a business owner can be a daunting task. As seasoned tax professionals with years of experience in preparing business tax returns, we understand the intricacies and challenges that come with this responsibility. That’s why we’ve compiled this list of valuable insights and expert tips to help you navigate the complexities of your inaugural business tax return.

Social Security is coming for a bigger chunk of your paycheck

The portion of personal income subject to Social Security tax has increased to $168,600 this year, up from $160,200 in 2023, which means some employees will have to pay roughly $521 more than they paid in 2023.

Tips for Filing Your Taxes as Soon as Possible—and Why You Should File Early

As the tax season approaches, individuals and businesses alike are gearing up to file their taxes promptly. However, the urgency to file taxes at the eleventh hour often leads to stress and oversight. Filing taxes early not only offers peace of mind but also presents a multitude of benefits. At Demian & Company CPAs, a leading expert in tax advisory services, we understand the intricacies of timely tax filing and its impact on financial planning. Here, we outline the strategic advantages and effective tips for filing taxes ahead of the deadline.

Unlocking Tax Success in Nutley, NJ: Streamline Your Tax Journey Today

Embarking on the tax season in Nutley, NJ, presents a distinctive set of challenges for residents. However, delving into the intricacies of local tax laws and implementing effective strategies can transform this often daunting experience into a manageable and potentially rewarding endeavor. In this comprehensive guide, we'll delve into specific measures tailored for Nutley residents, aiming to simplify their tax preparation journey and alleviate the typical burdens associated with the tax season.

Mastering Tax Preparation in Scotch Plains, NJ: Your Key to a Smooth Tax Season

Embarking on the tax preparation journey in Scotch Plains, NJ, presents a unique set of challenges for residents. Navigating through the intricacies of local tax laws requires a tailored approach, but with the right strategies, you can transform this typically daunting task into a manageable and even rewarding experience. In this comprehensive guide, we'll delve into specific measures crafted for Scotch Plains residents, offering insights to simplify their tax preparation journey and alleviate the usual burdens associated with the tax season.

Expert Tips for New Brunswick NJ Tax Preparation: Simplify Your Tax Season Today

Tax season in New Brunswick, NJ, with its myriad rules and regulations, can often feel like navigating a complex maze for residents. However, with a solid understanding of local tax laws and the adoption of efficient strategies, the experience can be transformed into a manageable and potentially rewarding one. In this comprehensive guide, we'll delve into specific steps tailored for New Brunswick residents to streamline their tax preparation process and alleviate the stress associated with tax season.

Expert Tips for Perth Amboy NJ Tax Preparation: Simplify Your Tax Season Today

Navigating the intricacies of tax season in Perth Amboy, NJ, requires a tailored approach to the local tax landscape. Just like in Cranford, residents in Perth Amboy need to be aware of specific regulations, deductions, and credits that can impact their tax liabilities positively. In this comprehensive guide, we'll explore practical steps designed for Perth Amboy residents to simplify their tax preparation process and turn tax season into a manageable and potentially rewarding experience.

Navigating Tax Changes in 2024: What You Need to Know

As we step into a new year, taxpayers across the country are likely focusing on filing their taxes for 2023. However, it’s important to anticipate and brace for potential changes in tax regulations that could significantly impact your financial planning for the coming year as well. Understanding these alterations is crucial for individuals, businesses, and tax professionals alike, as it directly influences tax liabilities, deductions, credits, and overall financial strategies. Let’s delve into the anticipated tax changes for your 2024 finances and what you need to know to navigate them effectively.

How to Earn Tax-Free Rental Income — Legally

Here’s how it works: You can rent out your personal residence (e.g., primary, secondary, or vacation home) during a significant event, for example, and any money earned from the short-term rental isn’t subject to income tax if the rental period doesn’t exceed 14 days in the tax year. That applies to any amount you charge for the rental. However, the income generated becomes taxable if you rent your personal residence for more than 14 days in a tax year. As a result, keeping track of your rental days with good documentation is crucial.

NY Minimum Wage Increase Begins January 1st

Beginning on January 1st, 2024, New York’s minimum wage will increase to $16 per hour in New York City, Westchester, and Long Island, and $15 per hour for the remainder of the State. Further increases of $0.50 per year will continue through January 1st, 2026. Starting in 2027, the NYS Department of Labor will establish future annual minimum wage increases tied to inflation and keeping pace with regional costs of living.

How much New Jersey's minimum wage will increase on Jan. 1, 2024

New Jersey’s statewide minimum wage will be raised by $1 to $15.13 per hour for most employees on Jan. 1, 2024. The increase was part of a scheduled hike stemming from a 2019 bill signed by Gov. Phil Murphy. The legislation phases in a $15 an hour minimum wage, which will be reached by 2024.

Expert Tips for Irvington NJ Tax Preparation: Simplify Your Tax Season Today

Navigating the complexities of tax season in Irvington, NJ requires a tailored approach that takes into account the unique local regulations and considerations. In this comprehensive guide, we'll explore specific steps designed for Irvington residents to simplify their tax preparation process and alleviate the stress associated with this annual task.

Expert Tips for Livingston NJ Tax Preparation: Simplify Your Tax Season Today

Embarking on the intricate journey of tax preparation in Livingston, NJ, presents its own set of challenges. However, unraveling the nuances of local tax laws and implementing effective strategies has the potential to transform this experience into a more manageable and potentially fulfilling endeavor. In this comprehensive guide, we will explore precise measures customized for Livingston residents to simplify their tax preparation journey, ultimately alleviating the burdensome nature often associated with the tax season.

What You Need to Know about Deducting Your Holiday Charitable Donations

As the holiday season approaches, many individuals engage in charitable giving to support causes close to their hearts. Not only does this act of generosity benefit communities in need, but it can also offer potential tax advantages. However, it’s important to understand how to take advantage of this added perk, so you can ensure that the donations you make are not only doing a lot of good in the world, but that they are also tax deductible for the approaching tax season. Keep reading to get tips and guidance that will help you better understand how your charitable donations impact your tax deductions.

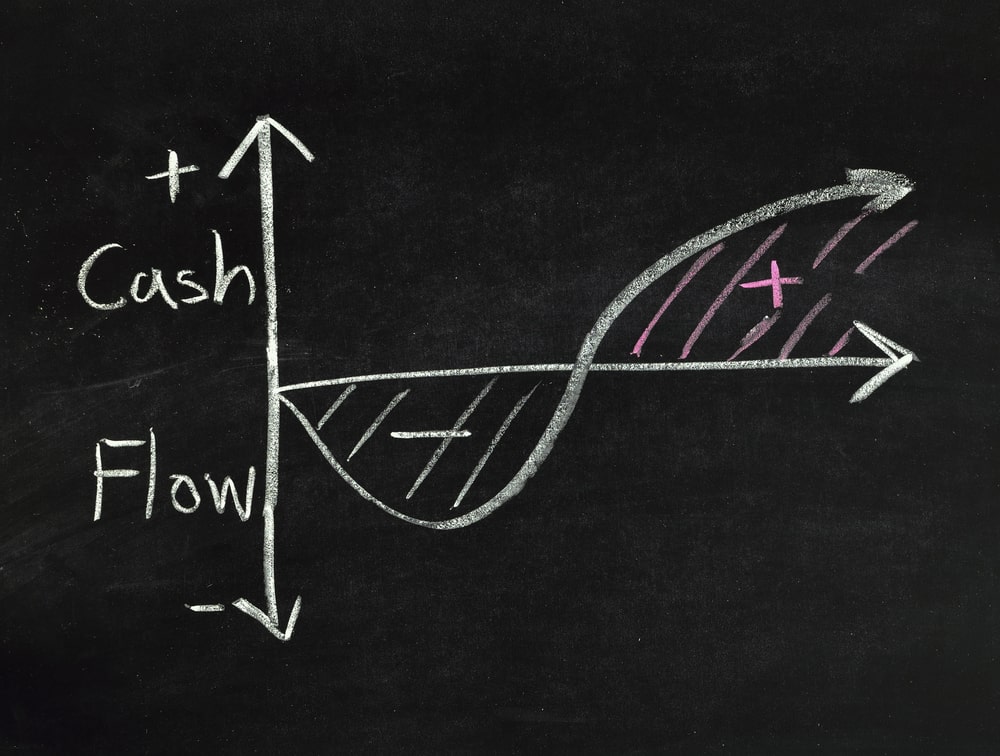

10 Tips for Managing Your Cash Flow to Your Business's Greatest Advantage

In the complex landscape of business management, one of the most crucial aspects that often remains underemphasized is cash flow management. Efficiently managing cash flow is vital to the survival and success of any business. At Demian & Company CPAs, we understand the significance of sound financial management, and we're here to provide you with professional insights and guidance to help you manage your business's cash flow effectively. Here are some helpful tips for managing your cash flow to your business's greatest advantage.