Updating Your Address with the IRS: How to Do It and Why It Matters

When you move, it seems there are countless entities that need your new address—credit card companies, magazine subscriptions, fitness memberships, etc.—and odds are high that you’re going to forget to change your address with a couple of them. But what about updating your address with the IRS? Most people don’t have this at the forefront of their mind when making a list of entities to which they must submit a change of address. In some cases, however, failing to update your address with the IRS can have major consequences. Keep reading to learn more.

When you move, it seems there are countless entities that need your new address—credit card companies, magazine subscriptions, fitness memberships, etc.—and odds are high that you’re going to forget to change your address with a couple of them. But what about updating your address with the IRS? Most people don’t have this at the forefront of their mind when making a list of entities to which they must submit a change of address. In some cases, however, failing to update your address with the IRS can have major consequences. Keep reading to learn more.

Why You Should Update Immediately

There’s a reason most people don’t think of the IRS when they’re making a list of entities that need their new address; you likely only deal with the IRS once a year, and when you submit your next tax return, they’ll get your new address anyways. While this is true, any tax-related communications they send between your move and when you file your next return will be sent to your old address. And when the IRS sends you a letter, it’s usually something you don’t want sent to the wrong house.

For example, the IRS may send a letter regarding your taxes that requires a prompt reply. By sending the notice to the address they have on file, the IRS has fulfilled their legal obligation to notify you of any issues related to your taxes; they are not responsible for an incorrect address. Even if you didn’t receive the letter because you no longer live in that house, any repercussions arising from your lack of response (late fees, penalties, having your account sent to collections, etc.) are still your own responsibility.

If you have your tax refund sent via check, and you move while awaiting your refund, your check will be sent to your old address. Of course, odds are that the check will make its way to your new home eventually. However, there will be significant delays in your receipt of those funds.

While you may already have a list a mile long of companies that need your new address, it’s important to add the IRS to that list, rather than waiting until you file your tax return. Even if you feel certain that the IRS has no reason to reach out to you before you file, the few minutes it takes to update your address are a small sacrifice to make when compared to the potential consequences of not doing it.

How to Submit a Change of Address

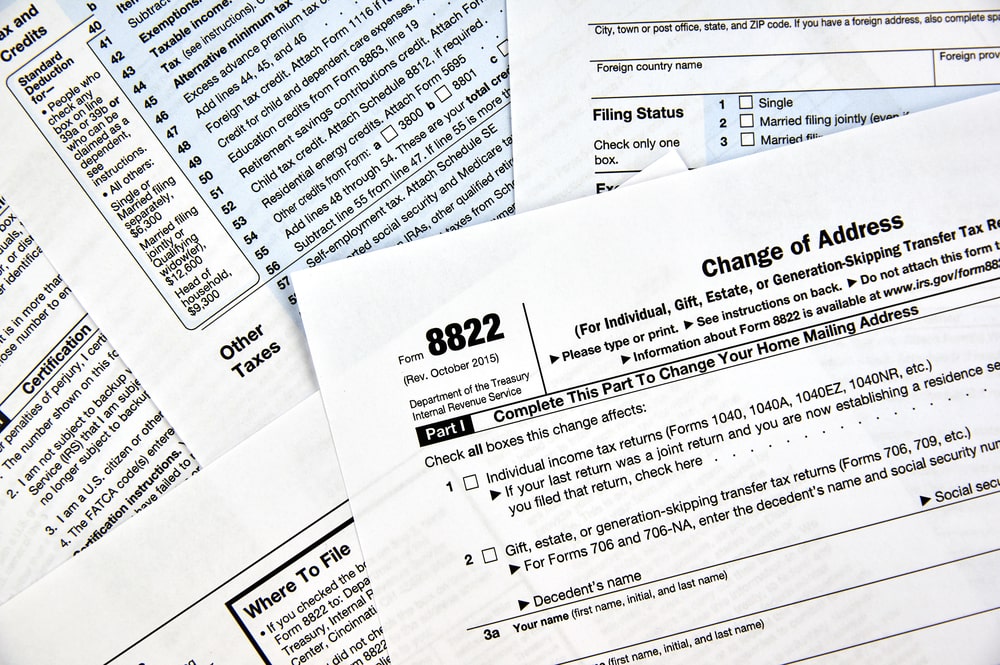

You have three options available to you for updating your address with the IRS. The first is to fill out and submit an IRS change of address form. A change of address with the IRS must be submitted on paper, but it doesn’t take long. You can print and fill out Form 8822 from the IRS website. The second page of the form will tell you what address you should mail it to, based on your previous address. Please ensure that you are sending the document to the correct IRS division based on your old address, not your new one.

Your second option is to write up and sign a statement that includes all of the following information:

- Full name

- Previous address

- New address

- SSN, ITIN, or EIN

You must then mail your written statement to the same location where you mailed your last tax return.

Your final option is to give an oral notification of your change of residence. If you live near an IRS office, you can do this in person; you can also call the IRS and provide notification over the phone. They do need to verify your identity to update your address, so make sure you can provide your full name, date of birth, address, and SSN, ITIN, or EIN when requested.

Forms for Spouses and Independent Children

If you have adult children who live with you but file their own tax returns, they will need to complete and submit a separate change of address form. This applies to each child in your home who files separate taxes.

However, you and your spouse can use the same change of address form, regardless of whether you file separately or jointly, so long as you’re still living together. If you and your spouse have established separate residences, you will need to each submit your own change of address form.

It’s important that the IRS always have your current address, so you can ensure you’re receiving all tax-related notifications. If you’re a client of Demian & Company CPAs, we can help you with updating your address with the IRS so that you have one less thing to worry about.